Video Games sales in U.S. January 2013

Analysis from NPD industry analyst, Liam Callahan

Overall

As NPD and most retailers follow the National Retail Federation calendar, the January 2013 reporting period will include the required "Leap Week" and is, therefore, a five week period. When comparing January 2013 results to January 2012, an adjusted figure can be computed for trend purposes: multiplying January 2013 sales figures by 0.80 (four-fifths) will normalize the five-week period to a four-week level.

For more details regarding the "leap week" added to January 2013, see the link below: www.nrf.com/modules.php?name=Pages&sp_id=391

These sales figures represent new physical retail sales of hardware, software and accessories, which account for roughly 50 percent of the total consumer spend on games. When you consider our preliminary estimate for other physical format sales in January such as used and rentals at $141 million, and our estimate for digital format sales including full game and add-on content downloads including microtransactions, subscriptions, mobile apps and the consumer spend on social network games at $382 million, we would estimate the total consumer spend in January to be over $1.3 billion. Our final assessment of the consumer spend in these areas outside of new physical retail sales will be reported in April in our Q1 Games Market Dynamics: U.S. report.

Overall retail video game sales (hardware, software, and accessories, would be down 13 percent, instead of up 9 percent, if sales were normalized to account for the 5-week January.

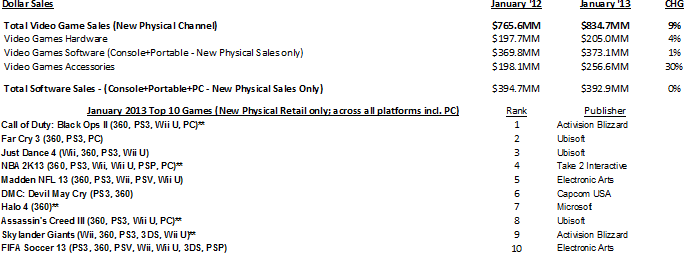

NPD Group's U.S. Games Industry Sales (New Physical Sales Channel*) - January 2013

5-week month; Reporting Period 12/30/12 through 2/2/13

Important Note : January 2013 Is A Five-Week Rather Than Four-Week Reporting Period

The 4-5-4 Week Retail Calendar utilized by NPD in North America measures out 12 reporting periods of four or five weeks, covering 364 days per year. That is one day short of the calendar year of 365 days. The consequence is that the reporting periods drift backwards on the monthly calendar by one day per year (accelerated by an additional day each Leap Year).

This requires the addition of a "Leap Week" every five to six years in order to preserve the seasonal integrity of the months. The January 2013 reporting period will include the required "Leap Week" and will, therefore, be a five-week period. If we did not add the additional week, the January reporting period would eventually include Christmas/holiday shopping. This adjustment was last made in January 2007.

The adjustment is consistent with the U.S.-based National Retail Federation's (NRF) published Retailer Calendar, which most retailers and NPD follow.

Hardware

When taking into account the 5-week month of January 2013, normalized sales of hardware were down 17%.

Xbox 360 led hardware sales again this month. This is the eighteenth consecutive month the platform led overall hardware sales and the twenty-fifth consecutive month it has led console hardware sales.

Software

Based on looking at trends of a normalized January 2013, software dollar trends were down 19% from January 2012.

Far Cry 3 ranked second highest in terms of unit sales and marked the first time since Jan 2002 with Final Fantasy X that a December launch has ranked second in the following January.

Ni No Kuni: Wrath of the White Witch, a PlayStation 3 exclusive, was just outside of the top ten game ranking at eleventh, but ranks seventh on an individual SKU basis.

PS3 software unit sales were only down 2% when normalized while 3DS unit sales only decreased 4% faring relatively better than other platforms over the same time period.

While the number of new SKUs was relatively consistent for January 2013 compared to January 2012, performance of new SKUs this year versus last was six times as high, lifted by the success of titles like DMC: Devil May Cry and Ni No Kuni: Wrath of the White Witch.

Accessories

Due to the success of Point Cards, Headsets / Headphones, and Skylanders, normalized sales for the Accessory category were up 4% versus January 2012.

January 2013 marked the best January for Point and Subscription Cards on record, another indication of the health of spending on digital content and services and how retailers can participate.

Skylander accessory sales continue to impress and made up five of the top ten accessory SKUs sold this month.