Worldwide digital games market: May 2016

The overall digital games market was up 11% year-over-year, earning $6.0 billion in May. Big winner was Overwatch earning $269 million in digital revenues across both PC and console, pushing the PC category up 8%. Subscription-based gaming on PC took a big hit in May, dropping below $200 million in total monthly earnings. Conforming to seasonal spending patterns, in combination with several strong releases on PC and console, mobile gaming revenue has been in decline three months in a row, after reaching a high of almost $3 billion in monthly sales in February. Mobile gaming revenue in May was $2.6 billion, still up 9% from the same month last year.

Blizzard's Overwatch dominates rankings leaving Battleborn in the dust. Newcomer this month Overwatch (Nasdaq: ATVI) tops May's revenue rankings with $269 million in earnings across PC and console. The new shooter game is proving to be a hit among online spectators and is currently the 5th most commonly streamed title across live streaming channels. Despite not being free-to-play, Overwatch is rolling out a long-term monetization strategy by offering a hefty quantity of vanity items, including skins and graffiti tags. Take-Two's Battleborn (Nasdaq: Ttwo) had a significantly poorer performance, earning an estimated $18 million.

Uncharted 4 ends on a $56M high note. The long-awaited end to the Uncharted series managed to push past Call of Duty: Black Ops III, making it the highest earning title on console in May. Over the course of its legacy, the appetite for digitally distributed games has grown significantly, as Uncharted 4 earning about selling almost six times more digital copies at launch than Uncharted: Nathan Drake Collection.

Online multiplayer gaming now a key element in console strategy. Last week at E3 we saw a spectacular lineup from Sony at E3 last week that featured several key titles with online game play. Microsoft doubled down on improving its Xbox Live infrastructure and social layer, and released details on its upcoming pirate-themed title, Sea of Thieves, which is the latest console game to heavily incorporate online multi-player elements. The platform holders have started to notice that additional content sales and a high-spending user base make for a lucrative combo, with games like Smite earning roughly the same on both console and PC, and titles like Destiny and The Division requiring users to be online at all times. For 2016 the market for online multi-player gaming is on track to reach $17.4 billion in revenues, in part driven by console now offering cross-platform game play.

Tencent cannonballs into the global mobile market by acquiring Supercell. Until now, Tencent's mobile operations have largely been limited to China, but this week's $8.6 billion acquisition of Softbank's majority stake in Supercell is about to change that. Supercell's titles consistently dominate mobile revenue rankings: Clash Royale and Clash of Clans earned a combined $193 million the past month, ranking 2nd and 3rd respectively. While Tencent already has international clout through its majority stake in League of Legends publisher Riot, the company is positioning itself as the dominant publisher in the $32.8 billion mobile market. Early signs of declining growth in the mobile games market is pushing the industry toward consolidation.

Facebook goes after $4.3B gaming video content market to compete with Amazon and Google. Having signed an agreement with Activision Blizzard that will allow players to log into Battlenet using their Facebook accounts and directly stream gameplay to its main canvas, Facebook has entered the market for streaming video. Starting with Overwatch, Facebook is poised to play an important role in connecting users with content. Despite being a latecomer, Facebook thinks its network infrastructure and massive user base is enough to close the gap with established streaming platforms Twitch and Youtube Gaming. Facebook's entry into the space may serve as a catalyst for competitive gaming, which is a major content category across live streaming channels, and on track to earn $892 million this year.

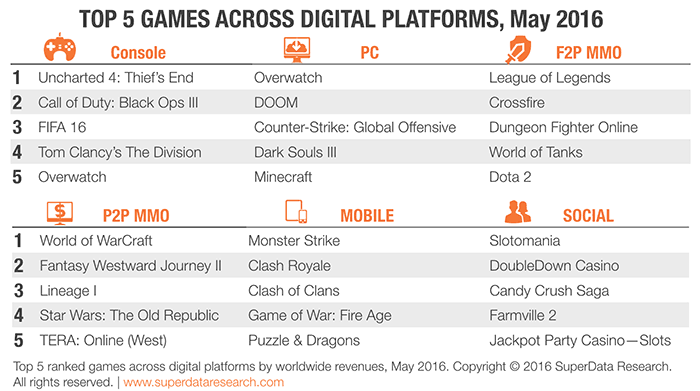

| Top Grossing Mobile Games by Revenue, May 2016 | ||

|---|---|---|

| 1 | Monster Strike | Mixi |

| 2 | Clash Royale | Supercell |

| 3 | Clash of Clans | Supercell |

| 4 | Game of War: Fire Age | Machine Zone |

| 5 | Puzzle & Dragons | GungHo |

| Top Grossing PC DLC Games by Revenue, May 2016 | ||

| 1 | Overwatch | Activision Blizzard |

| 2 | Doom | Bethesda |

| 3 | Counter-Strike: Global Offensive | Valve |

| 4 | Dark Souls III | Bandai Namco |

| 5 | Minecraft | Microsoft |

| Top Grossing Free-to-play MMO Games by Revenue, May 2016 | ||

| 1 | League of Legends | Tencent |

| 2 | Crossfire | Neowiz Games |

| 3 | Dungeon Fighter Online | Nexon |

| 4 | World of Tanks | Wargaming |

| 5 | Dota 2 | Valve |

| Top Grossing Pay-to-play MMO Games by Revenue, May 2016 | ||

| 1 | World of Warcraft | Activision Blizzard |

| 2 | Fantasy Westward Journey Online II | NetEase |

| 3 | Lineage I | Ncsoft |

| 4 | Star Wars: The Old Republic | Electronic Arts |

| 5 | Tera Online | En Masse |

| Top Grossing Social Games by Revenue, May 2016 | ||

| 1 | Slotomania | Caesars Entertainment |

| 2 | DoubleDown Casino | IGT |

| 3 | Candy Crush Saga | Activision Blizzard |

| 4 | FarmVille 2 | Zynga |

| 5 | Jackpot Party Casino —SlotsS | Slotomania |

| Top Grossing Console Games by Revenue, May 2016 | ||

| 1 | Uncharted 4: Thief’s End | Sony |

| 2 | Call of Duty: Black Ops III | Activision |

| 3 | FIFA 16 | Electronic Arts |

| 4 | Tom Clancy’s The Division | Ubisoft |

| 5 | Overwatch | Activision Blizzard |